Last week I was surprised when the US Government’s retail sales data hit a new high. No way, I said.

Well, Way!

Yes, some retailers are seeing booming sales, particularly online, and … wait for it…

Grocery stores. Even after pulling back from the lockdown spike, they’re still up more than 7% year to year.

Now there’s a basis for a thriving, growing US economy.

Not.

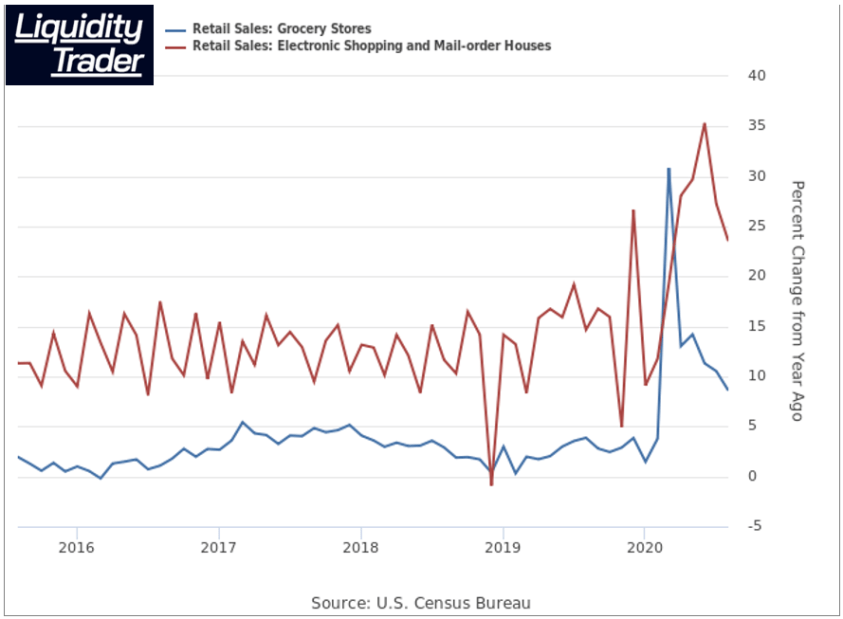

And of course, there’s the surging growth in e-commerce. I’ve put it on a chart along with grocery sales going back 5 years for perspective. The average growth rate, which was already a sizzling 10-15% per year, has roughly doubled in e-commerce. The average growth rate for groceries has tripled. Apparently pandemics are good for some businesses.

Something struck me about this chart, apart from the COVID driven surge. Over the past few months, the annual growth rates in both series have been plummeting. “Growth” ain’t what it used to be. This drop implies contraction since July.

But my purpose here is not to pretend to be an eConomist. I just wanted to point out the government statistics, particularly those that the financial news headline writers feature, don’t tell the whole story.

Furthermore, we know that these sales are just coming out of the hides of other businesses. Lodging, travel, recreation, and transportation sales have collapsed. Gross tax collections show us the truth. The US economy is dead in the water, not growing at all, while remaining at a level a few percent below what it was last year at this time. It’s hard to gauge just how much in real terms, because we really have no clue how high inflation really is. But the nominal actual totals are lower and flat.

That’s what this report focuses on.

The issues then facing us are whether this will be the basis for more stimulus. That would mean more spending, more debt issuance, more pressure on the financial markets, and a need for more Fed support to prevent a market meltdown.

Here’s what the current Federal tax collections data tells us about what the real condition of the economy is, and what to expect as a result.

Subscribers, click here to download the report.`

Available at this link for legacy Treasury subscribers.

KNOW WHAT’S HAPPENING NOW, before the Street does, read Lee Adler’s Liquidity Trader risk free for 90 days!

Act on real-time reality!

You must be logged in to post a comment.