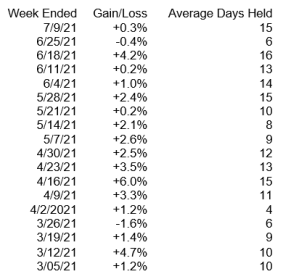

I often refer to rangebound markets as meat grinders for swing trading purposes. The more tightly rangebound they become, the more false signals are generated, and the more whipsaws there are. This market certainly qualifies. Last week’s list got ground to a pulp. All 6 picks had minor losses. Two got stopped out, and one will be dropped as of today’s open.

In the weekly market update, we saw a pileup of inconclusive data. Again, the trading range is both cause and effect of the lack of conviction by either buyers or sellers. The market hasn’t yet tipped its hand on which way it will break out. Both for the broad market indicators and the individual stock charts, the data simply screams for us to do nothing.

Last week, I even warned about that, despite a huge number of buy signals.

The enormous bullish spread on Friday would normally suggest thrust, and a new upleg, meaning that this rally would be likely to run for weeks. But, once again, I wasn’t impressed after eyeballing all 152 of the charts with signals. Most looked to be of the rangebound whipsaw variety. I didn’t see that many that appeared to be in an early upmove setup.

Unfortunately, I found 5 charts last week that I liked enough to add to the list. Blech.

This Friday’s screens were even-steven with 27 buy signals and 29 sell signals. Not only did the ambiguity show up on the list as a whole, but the individual charts were equally ambiguous. Lots of rangebound whipping, with little sign of either an up or down follow through. One of the charts even had signals in both directions.

In the end I only found one that I thought had a decent low risk, high potential reward setup. That was ….., and it was a short.

Get the newest pick and review charts of existing picks in today’s report. Technical Trader subscribers click here to download the complete report.

You must be logged in to post a comment.